Is "Buy Term and Invest the Difference" Always Best? Let’s Math the Heck Out of It

By: Felix Diaz, P. Eng.

You’ve probably heard it: “Just buy term life insurance and invest the difference (BTID)”. Its the go-to advice in personal finance circles. But does it always hold up—especially over the long haul?

And also when it comes to life insurance, few debates stir up more passion than Buy Term and Invest the Difference (BTID) versus Universal Life (UL). Advocates on both sides make compelling arguments—but what happens when we strip away the sales language and run the numbers?

Let’s math the heck out of this. Let’s objectively dissect and compare using three strategies using a $500/month budget over 30 years. We’ll break down insurance costs, tax impact, and investment growth to see which option truly delivers. The insurance coverage is $500,000 for 30 year old healthy and non-smoking male. The investments in all 3 options are all assumed at yearly compounding interest of 6%.

The Three Strategies at a Glance

Before we dive into the numbers, here’s a quick overview of the options we’re comparing:

TFSA + Term Life Insurance

You buy low-cost term coverage and invest the rest in a Tax-Free Savings Account, where all growth and withdrawals are tax-free. It’s flexible, efficient, and widely recommended.Non-Registered Segregated Fund + Term Life Insurance

Similar to the TFSA strategy, but your investments go into a non-registered segregated fund. These offer principal guarantees and creditor protection, but investment gains are taxed annually.Universal Life Insurance (UL)

A bundled product that combines permanent life insurance with a tax-deferred investment account. It offers long-term protection and estate planning benefits.

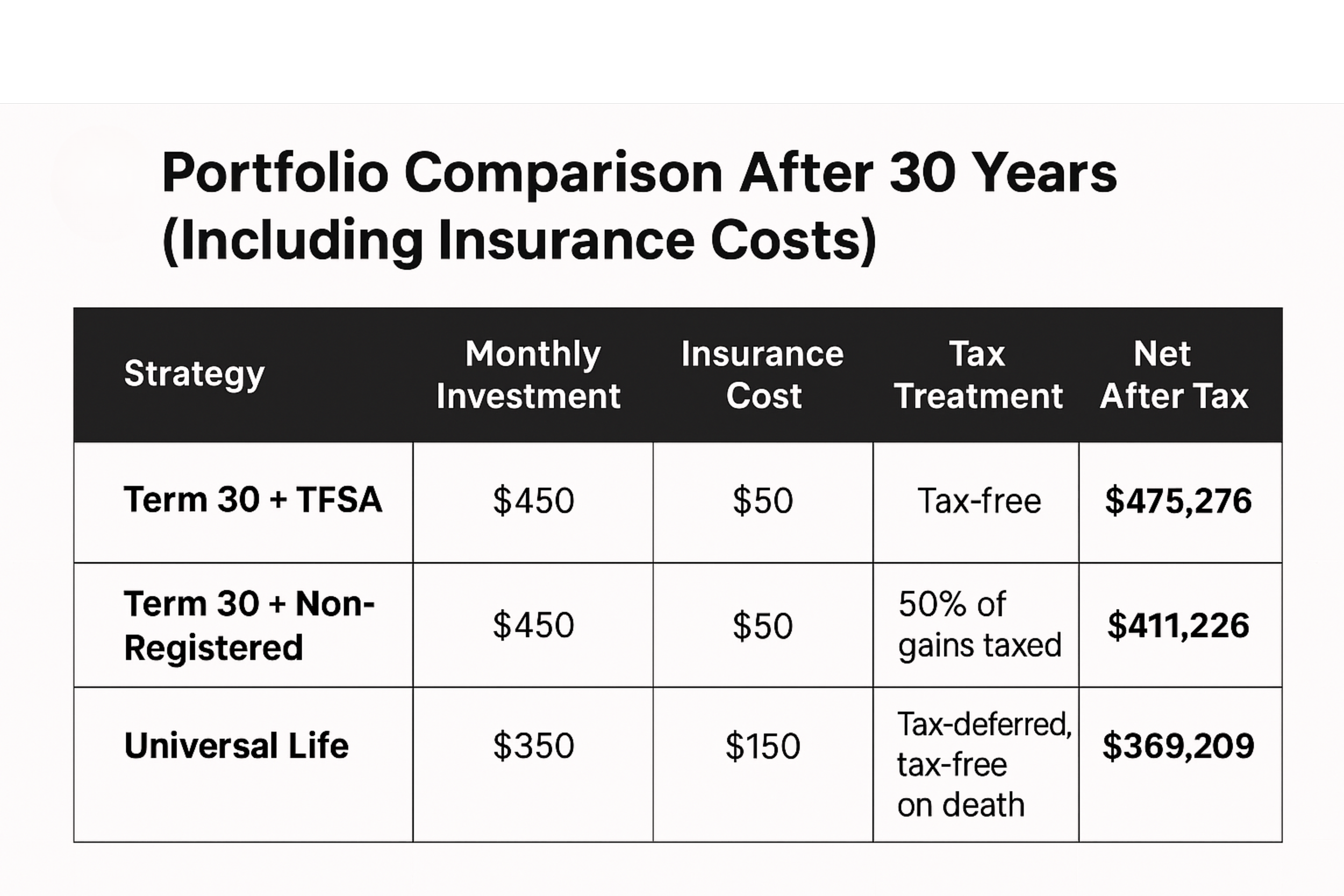

Table: Apple-to-apple cost breakdown comparison

Key Takeaways

When we focus purely on the numbers, the TFSA paired with Term Life Insurance (BTID strategy) generates higher portfolio growth. Even after factoring in the cost of 30-year term coverage—over $18,000 ($50/month for 30 years)—BTID still outpaces Universal Life by approximately $80,000 in the TFSA scenario and $24,000 in the non-registered segregated fund comparison.

BTID is a strategy, not a product. You purchase term life insurance—simple, low-cost coverage for a fixed period—and invest the money you save (the “difference”) in a separate portfolio, often in a TFSA, RRSP, or non-registered account.

Why it appeals:

Lower premiums = more cash flow for investing

Full control over investment choices

Transparent fees and performance

Flexibility to adjust as life evolves

However, one key advantage of Universal Life (UL) is what happens after year 30. At that point, the combined value of the death benefit and accumulated cash in the UL policy continues to grow and will outpace the BTID—because the term insurance has expired and holds no remaining value. With BTID, only the investment portion remains..

Moreover, financial planning isn’t just about chasing the highest return. It’s about aligning your strategy with your life goals, risk tolerance, and long-term vision.

So the real question becomes:

Does the added long-term value of UL justify the difference in early growth?

For many, the answer may be no. But for others—especially those with specific legacy, protection, or planning goals—the answer could be yes. It all depends on your priorities.

When Does Universal Life Insurance Make Sense the Most?

Lifetime Coverage

UL provides permanent protection—you’re covered for life.

BTID only covers you during the term; after that, coverage ends or becomes prohibitively expensive.

Creditor Protection (in some provinces)

UL policies with named beneficiaries may be shielded from creditors.

BTID investments generally lack this protection unless held in registered accounts.

Flexible Premiums and Coverage

UL allows you to adjust premiums and death benefit over time.

BTID offers fixed premiums and requires separate management of your investments.

No Contribution Limits

UL has no annual cap on contributions (within Exempt Test rules).

BTID may be limited by RRSP/TFSA contribution room or tax drag in non-registered accounts.

Legacy Planning

UL is ideal for leaving a guaranteed, tax-free legacy to children, grandchildren, or charities.

BTID requires careful market timing and tax planning to achieve similar outcomes.

For incorporated Canadians, UL offers powerful planning advantages:

Corporations can own UL policies for tax-efficient estate planning, wealth transfer, and exit strategies.

The death benefit flows tax-free to the Capital Dividend Account (CDA), enabling tax-free distribution to shareholders.

Cash value grows tax-deferred, and premiums can be paid with after-tax corporate dollars, which are taxed at a lower rate than personal income.

If your financial strategy includes legacy planning, wealth preservation, or tax-efficient retirement income, then UL isn’t just a backup plan—it’s a strategic asset.

Curious Which Strategy Fits You Best?

There’s no one-size-fits-all answer when it comes to life insurance and investing. Each option—whether it’s TFSA + Term Life, Universal Life Insurance, or a non-registered strategy—has strengths depending on your goals, timeline, and financial situation.

If you're exploring your options and want to understand what might work best for your unique needs, I’d be happy to chat.

Let’s connect for a no-obligation consultation—a relaxed, informative conversation to help you clarify your priorities and explore strategies that align with your life.

Email: diaz.felix@gmail.com

Phone: 403-498-4775

or leave us a message below.